Nvidia Stocks Heads Higher: Gains 50% Since Its April Lows

After a rough Q1, Nvidia is storming back. Shares have rallied 50% since their April bottom, driven by a game-changing Saudi AI deal and U.S. policy shifts under Trump. So what’s fueling this climb, and what’s next for investors?

Summary

- Nvidia stocks have surged 50% since April’s dip following a major AI partnership and easing trade worries.

- Trump reversed AI chip export restrictions, benefiting NVDA and impacting Huawei.

- Saudi Arabia’s Humain to partner with Nvidia for a massive AI data center powered by 18,000 GB300 GPUs.

Trump Ends AI Export Rule, Lifts Nvidia Stocks and Hurts Huawei

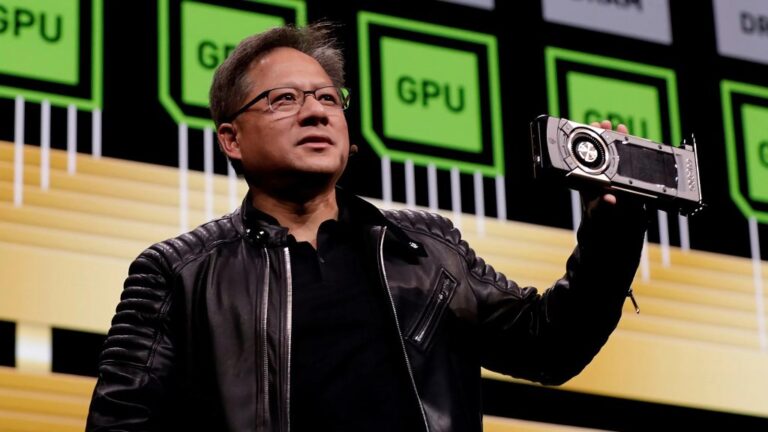

The major headline boosting Nvidia stocks is President Donald Trump’s decision to eliminate the “AI diffusion rule.” This policy had restricted exports of high-end chips, especially affecting Nvidia’s ability to sell globally. Now that those restrictions are gone, Nvidia’s advanced GPUs can again be sold freely — something Huawei won’t be happy about. U.S. regulators also stated that purchasing Huawei chips would now violate federal rules.

Saudi Arabia AI Deal: 18,000 Chips, $3 Trillion Valuation

On the same day Trump landed in the Middle East, Nvidia revealed a mega-deal with Humain, a Saudi AI company backed by the kingdom’s sovereign wealth fund. The agreement involves building a massive AI data center with 18,000 of Nvidia’s GB300 GPUs — a move that sent the company’s market cap back above $3 trillion. At one point, Nvidia even briefly overtook Apple in market value before slightly pulling back.

Chart Breakout: 200-Day MA and Key Resistance

From a technical angle, Nvidia recently broke out of a falling wedge pattern and closed decisively above its 200-day moving average — a sign of strength. Volume was the highest in weeks, suggesting strong buyer interest. The RSI indicator also shows bullish momentum, sitting just below the 70 mark (nearing overbought territory).

Price Targets and Key Levels to Watch

Investors are watching two crucial resistance points:

- $130: Could act as resistance, as it links back to past peaks.

- $150: A major zone where previous highs formed, and where profit-taking may occur.

On the downside, $115 is a key support level near the breakout area and 50-day MA. If selling deepens, Nvidia could test support at $96, a spot where long-term bulls might jump back in.

Can Nvidia Overtake Apple for Good?

As of this week, Nvidia’s value stands at $3.17 trillion, while Apple sits at $3.18 trillion. With Nvidia climbing and Apple dipping, the race is tight. Given the AI boom and Nvidia’s role in powering global infrastructure, many believe NVDA could hold the crown soon — especially if more global AI partnerships are announced.

Pros

Pros

- Lifted chip restrictions expand global sales

- Massive Saudi AI deal unlocks long-term growth

- Technical breakout signals strong bullish trend

Cons

Cons

- RSI nearing overbought territory

- Resistance near $130-$150 could trigger pullbacks

- Broader trade uncertainty still lingers

Final Verdict

Nvidia stocks have made a dramatic comeback, and it’s not just hype. Between trade rule reversals, a blockbuster Saudi deal, and a strong technical setup, NVDA is once again the market’s AI king. If it breaks past $130 cleanly, don’t be surprised if it leaves Apple in the dust soon.

FAQs

Q: Why did Nvidia stocks jump 50% recently?

A: A major AI deal with Saudi Arabia and the reversal of AI chip export restrictions under Trump sparked the rally.

Q: Is Nvidia now more valuable than Apple?

A: Almost — Nvidia briefly surpassed Apple but is still just behind by about $10 billion in market cap.

Q: What are the key price levels to watch for Nvidia?

A: Watch $130 and $150 for resistance, and $115 and $96 as support during dips.