Dow Rises 221 Points as Nasdaq Struggles with Big Tech Decline

Hey everyone, let’s dive into what’s been happening in the market lately. It’s been a bit of a rollercoaster, with some sectors doing great and others not so much. Today, we saw the Dow make some solid gains while the Nasdaq took a bit of a tumble. It’s a mixed bag out there, and it’s super important to understand what’s going on, especially if you’re like me and trying to make smart investment choices.

Market Performance Overview

Okay, let’s get into the specifics. The Dow Jones Industrial Average had a pretty good day, adding 221 points, which is about a 0.5% increase. The S&P 500 also managed to nudge up a little, about 0.1%. But, the Nasdaq Composite, which is usually where the big tech companies hang out, slipped by about 0.2% or 0.23%. So, we can see that not everything is moving in the same direction, which is something to keep in mind.

Now, looking at different sectors, it’s clear that some are doing better than others. The financial and utilities sectors are looking strong, while the tech sector, particularly the big names in tech, isn’t doing so well. Small-cap stocks, like those in the Russell 2000, are outperforming, too. So, it’s not just a one-size-fits-all kind of day in the market.

The Influence of Economic Data

So, what’s driving all this movement? Well, a lot of it has to do with economic data, particularly inflation. We recently got the Producer Price Index (PPI) report, and it was a bit lower than expected. This is good news, as it suggests that wholesale inflation isn’t as high as we thought. The core PPI, which doesn’t include volatile food and energy costs, was also flat, so that’s interesting to see.

But, even with this data, there’s still some uncertainty among traders. Everyone’s waiting for the Consumer Price Index (CPI) report, which comes out on Wednesday. This report will show how much consumers are paying for things like groceries, gas, and cars. It’s going to be a big deal because it’s a key report that influences what the Federal Reserve does with interest rates. If inflation doesn’t cool down, it might affect how the Fed approaches interest rate changes.

Interest Rate Expectations and Bond Yields

Speaking of interest rates, a lot of people had hoped for some rate cuts soon, but those hopes are fading. Traders are now betting that there won’t be any rate cuts until at least September. And even then, the Fed might only lower borrowing costs a little bit, maybe just two times this year.

This shift in expectations is impacting bond yields, especially the 10-year Treasury yield, which has been climbing. As bond yields rise, it can put pressure on the stock market and especially on tech stocks because borrowing money becomes more expensive.

Sector-Specific Analysis

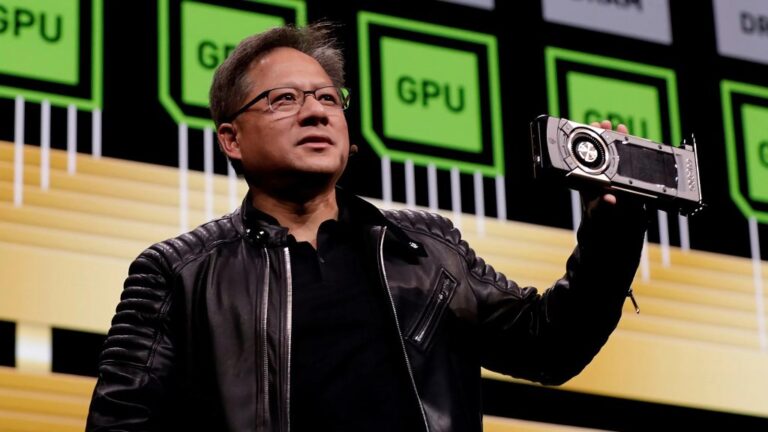

Let’s take a closer look at some specific sectors. The tech sector is seeing a bit of a sell-off, especially among the “Magnificent Seven” stocks. For example, Nvidia (NVDA) is down because of some new export rules about AI chips. We also saw declines in Apple (AAPL), Meta (META), and Tesla (TSLA).

On the flip side, the financial sector is doing pretty well. The SPDR S&P Regional Bank ETF (KRE) and SPDR S&P Bank ETF (KBE) both jumped about 3%. The energy sector is also seeing some action as oil prices climb. Brent crude has gone past $81 per barrel due to supply worries and some geopolitical issues.

Geopolitical and Economic Influences

Geopolitical issues like sanctions on Russian oil are also playing a big role in the markets. These sanctions have created concerns about supply, which is driving up prices. This is affecting big importers like China and India.

Another factor is the strong US dollar. If you think about it, a strong dollar can hurt companies with international sales because it makes their products more expensive in other countries, which is known as FX headwinds. But it seems like the market isn’t reacting too negatively to those companies who miss sales estimates on this basis. Generally speaking, companies that focus on domestic sales do better when the dollar is strong.

Also, individual company news can really shake things up. For instance, Edison International’s stock dropped because they’re being investigated for a possible connection to the Los Angeles wildfires. Moderna’s stock also took a hit after they lowered their sales forecast. On the other hand, Honeywell’s stock rose on reports they might break up, and US Steel jumped on news about potential acquisition bids.

Investment Strategies and Best Practices

So, what do we do with all this information? It’s a good idea to diversify your investments to spread out risk. Instead of putting all your eggs in one basket, look at different sectors. Also, try to avoid getting caught up in short-term market swings. Remember, long-term goals are key. Keep an eye on those economic reports like the PPI and CPI. Staying informed about company news is also a great habit. It’s also wise to understand your own tolerance for risk before making any investment choices.

Alternative Assets

Don’t forget that there are other types of assets out there, like Bitcoin and crude oil. Bitcoin has seen a surge, while crude oil has dropped a bit. However, these assets can be risky, so it’s good to do your research before jumping in.

Psychological and Behavioral Aspects of Trading

Remember that emotions like fear and greed can really impact market behavior. Being aware of your own biases can help you make better investment decisions.

Conclusion

So, that’s the market in a nutshell today: mixed and volatile. The Dow is doing well, tech is lagging, and economic data continues to play a major role. It’s really important to stay informed, understand the different factors affecting the market, and use sound investment strategies.

Also Read:

- IRS Stimulus Checks: Are You Eligible for the $1,400 Payment?

- IRS Announces January 27 as the Start of the 2025 Tax Season

- Verizon Class Action Settlement: Key Details on Payments, Eligibility, and More

- Tesla’s Deliveries in Q3 2024: Wall Street’s Consensus Expectations Barely Met, Stocks Remain Flat